The real estate market in Dubai is developing rapidly, as this Emirate is becoming a more popular business destination. A property to buy in Dubai seems like a good investment choice for many foreigners looking to do business in this area. Either for personal use or for renting purposes, if you want to buy a villa in Dubai, you should consider the market and the available offers. Our lawyers in Dubai can assist you throughout the purchase process and help you conclude the necessary purchase agreements in Dubai. Our property lawyers in Dubai are at your service for information on resale properties.

| Quick Facts | |

|---|---|

| Specific legislation applicable (YES/NO) |

– Law No. 6 Concerning Ownership of Jointly Owned Real Property in Dubai, – Law No. 4 Concerning the Real Estate Regulatory Agency, – Law No. 7 Concerning the Land Department in Dubai |

|

Possibility of foreigners to acquire UAE properties (YES/NO) |

Yes |

|

Types of properties that can be purchased in Dubai |

– residential, – commercial, – industrial |

| Real estate due diligence required (YES/NO) | No, but recommended. This service can be offered by our real estate lawyers in Dubai. |

| Documents to prepare for property acquisition |

– pre-sale agreement, – sale-purchase contract, – identification papers for the seller and buyer |

| Financing options availability (YES/NO) |

Yes, mortgages are available for property purchases in Dubai. |

| Special property acquisition programs for foreign citizens (YES/NO) |

Yes, Dubai has several residency programs that enable real estate acquisition. |

| Timeframe to acquire a property in Dubai (approx.) |

1 – 2 months |

| Fees to consider upon a property purchase |

– notary fees, – Land Registration fees, – Property Title issuance fee |

| Registration requirement (YES/NO) | Yes, the property must be registered with the Dubai Land Registry. |

| Special requirements for foreign buyers (if any) |

Yes, foreign citizens must obtain No Objection Certificates before acquiring properties. |

| Residency requirements for foreign citizens buying real estate |

No, foreign citizens do not need to be residents, however, they can secure residency through property acquisition. |

| Possibility to appoint a local representative during the transaction (YES/NO) |

Yes, you can rely on our property lawyers in Dubai. |

| Property tax rate in Dubai |

There is no property tax in Dubai. |

| Support in buying a property in Dubai (YES/NO) | Yes, our law firm in Dubai can help you buy a property. |

Can foreigners purchase properties in Dubai?

Yes, regardless of their nationality, foreigners in Dubai can buy properties, can rent or sell houses in compliance with the local laws.

Foreign citizens have the possibility of buying properties in Dubai in two areas:

- freehold areas;

- leasehold areas.

The Dubai real estate market opened in 2002 for foreign citizens and investors and ever since it has known a great development. It is also useful to note that both freehold and leasehold areas are usually located near the heart of the Emirate.

Our property lawyers in Dubai can help you verify if real estate meets the requirements to be purchased by a foreign citizen.

How to find a property to buy in Dubai

Dubai is one of the most flourishing cities in the world and owning a property here is some people’s dream. The development of a great number of real estate projects in the past few years has eased the purchase procedure while also making it difficult for foreign citizens to find a suitable location.

A real estate agency can help in this sense, however, prospecting the market it is also possible from another country before coming to Dubai. Here are some of the main aspects to consider before buying a property in this Emirate:

- the area in which it is located (some neighborhoods are more expensive than others, just like in Western countries);

- whether the property will be bought in cash or if a mortgage will be required;

- the average time a real estate transaction is completed takes around one month;

- a No Objection Certificate (NOC) must be obtained prior to starting the purchase procedure.

As a tip, most properties in Dubai are bought in cash, however, in the past few years, mortgages have also started becoming an option among UAE nationals and foreigners. Most banks in Dubai offer advantageous mortgage conditions. It is also relatively simple to obtain a property loan as a foreigner in Dubai.

Upon the purchase of a property, both the buyer and the seller must pay certain fees which can be explained by our lawyers in Dubai.

Once purchased, it is the buyer’s duty to register the new property title with the Dubai Land Register.

If you need information on the Dubai property laws you need to respect as a foreigner, you can obtain the solicited information with our lawyers.

How can I buy a property in Dubai?

Before purchasing a property, it is best to check if that developer is approved by the Real Estate Regulatory Agency. This can be done on their website. As a buyer, you will need to pay close attention to some important aspects, like the final price of the property, if the property is finished, or if there will be any additional construction work. The first step when purchasing a property in Dubai is to come to a verbal agreement with the seller. After the initial details have been negotiated, the buyer and the seller draw up a formal sales contract. Usually, an initial deposit is also made during this stage. Foreign investors should also know that buyers must be at least 21 years old. It is good to know that the Real Estate Regulatory Agency in Dubai is the one responsible for approving registered developers in Dubai.

What is a resale property in Dubai?

Foreigners have the option to choose between several types of properties in Dubai, including “resale” properties. This type of property is purchased from a private seller and the two parties usually agree upon a memorandum of understanding which is a document that describes the terms and conditions for the sale. Foreign buyers also have the option to get a mortgage in Dubai. Although mortgage lenders can impose certain strict conditions to allow the approval of a mortgage, foreigners who want to apply for a mortgage in Dubai need to submit the following documents:

- passport copies of the persons who want to buy the property;

- a proof of residence and the address in Dubai (the permanent residence permit is solicited);

- evidence of a regular income for individuals working in Dubai;

- bank account statements proving the registered incomes in Dubai.

You can also rely on us for various immigration services. Foreign nationals who want to work as independent contractors in Dubai or the UAE must obtain a license there. Permits for working as a freelancer are offered in particular free zones. It is possible for instance to obtain a freelance visa in Dubai with the help of our immigration specialists who can verify your eligibility for the selected type of activity.

Buying freehold properties in Dubai

Directed mostly for foreign investors, freehold properties in Dubai are land parcels that can be used for future developments like residential homes or office buildings. Such freehold properties are usually sold by real estate companies in Dubai. We can handle the legal aspects of freehold properties and we can also make the necessary verifications before sealing any contract in this sense.

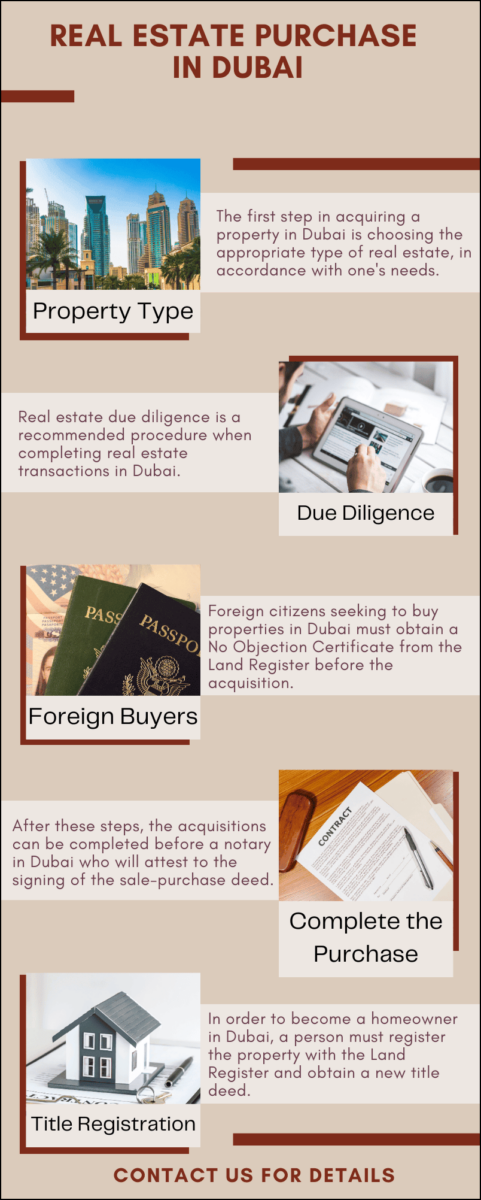

We also have an infographic on this subject:

The sale-purchase agreement for a property to buy in Dubai

No matter if you are about to buy a villa or apartment in Dubai, the first thing to do is to discuss and agree upon the terms of sale with the seller.

You have two choices when buying real estate in Dubai and the UAE:

- pay cash;

- file an application for a mortgage.

The main advantage of paying cash for a property instead of using a mortgage is the increased possibility to negotiate with the seller. While for this step, you will not need a real estate agent, for the following ones you will. The next stages imply drafting the legal agreement of the transaction for which you can rely on our Dubai law firm.

Signing the sale agreement is the second stage when you buy a property in Dubai. One of the aspects you should note is that the Dubai Land Department has standard forms (the F Form) for this contract. Our lawyers can download and draft it for you.

When the contract is ready, it must be signed by the buyer and seller with a public notary, in front of a witness.

In addition, the buyer must give the notary a 10% security deposit, which is reimbursed after the property transfer is completed.

If you want to buy a villa in Dubai, you should also consider the due diligence procedures associated with the acquisition of a large property. We remind you that you can purchase real estate in the UAE with the help of an investment visa in Dubai.

The No Objection Certificate when you buy property in Dubai as a foreigner

The buyer will apply to the developer for a No Objection Certificate (NOC) when the seller gives the final permission. To finish the transfer, an appointment must be made at the Land Department. Only in the event that there are no unpaid service fees on the property would the developer grant the No Objection Certificate (NOC).

This is also a requirement if you want to buy an apartment in Dubai. Feel free to get in touch with our lawyers in Dubai if you want to apply for an NOC and need assistance.

Transfer of ownership

The final legal step in purchasing a property in Dubai is to meet the seller at the Dubai Land Department office in order for the transfer to be finalized once you have received the NOC.

When you visit the Land Department office, you need to have the following paperwork available in order for the property transfer to go through:

- proof of payment for the property (a cheque or bank statement are the most common documents used when you buy a property in Dubai);

- the buyer’s and seller’s original identifying documents (passport, Emirates ID)

- the F Form signed by the developer with the original NOC.

You will become a property owner in Dubai once the formalities are completed and a new title deed is issued in your name. We remind you that you can rely on us for assistance in such an endeavor.

Obtaining residency in Dubai through property purchase

Real estate investment in Dubai comes with many benefits for foreign citizens seeking to relocate here for long periods of time. For this purpose, the investor visa was created, and under it, various requirements must be met by the foreigner who wants to become an owner under the Dubai property law.

The following options are available for those interested in obtaining residency based on a property purchase in Dubai:

- an investment of at least 1 million AED in a freehold property that grants a 3-year renewable residence permit;

- an investment of at least 5 million AED for a 5-year renewable residence permit;

- an investment of 2 million AED for a 5-year renewable visa for retired persons aged above 55.

The procedure of buying a property in Dubai this way is quite simple as it does not even require a residence permit upon arrival in the Emirate.

There is also the possibility of getting in contact with a real estate agency or our property lawyers in Dubai who can complete the formalities after finding a suitable property.

If you need to know more about Dubai property law, you can simply ask our specialists about its highlights.

How much does it take to buy a property in Dubai?

Property transactions in Dubai take approximately 30 days from the time the sale contract has been signed by both parties. The legal aspects of a property purchase can be explained by our team of attorneys in Dubai.

Do I need a deposit when buying a property in Dubai?

Yes, in most cases, it is mandatory to deposit at least 10% of the property price in a bank account in Dubai. This is normally a guarantee that the property transaction is established, and the terms will be respected as agreed by a contract in this sense. You can also watch our video on this topic below:

Taxes related to property purchases in Dubai

One of the greatest advantages of buying real estate in Dubai, whether for residential or commercial purposes, is that there are no taxes related to the transaction itself. One must only pay the property transfer fee and the stamp duty. The transfer fee must be paid when registering the property with the Dubai Land Department and is set at 4% of the purchase price, while the stamp duty usually ranges between 1 and 7 percent of the buying price. Please bear in mind that the charge for the real estate agents’ services is set at a 2% rate of the property price.

What to consider when choosing to acquire real estate in the UAE

When you decide on a property to buy in Dubai, whether for personal use or as an investment, take into account the following factors:

- the facilities and services which may include easy access to childcare, education, and transportation;

- the size;

- the state of the market and the time of purchasing;

- maintenance expenses.

Feel free to address our Dubai lawyers if you need legal advice on the main aspects to consider before buying an apartment or a villa.

In Dubai, purchasing a home can take from 2 to 10 weeks. If the property is already mortgaged or was bought with a mortgage, the process can take longer.

The Dubai Property Law

Dubai is the best-known city in the United Arab Emirates, and as such the number of foreign citizens living here has increased substantially in the last decade. For these and for those who are considering relocation, the government has implemented a few laws related to buying, renting, and owning real estate in Dubai.

The main laws providing for real estate in Dubai are:

- Law No. 6 Concerning Ownership of Jointly Owned Real Property in Dubai;

- Law No. 4 of Concerning the Real Estate Regulatory Agency;

- Law No. 7 Concerning the Land Department in Dubai;

- Decree No. 26 Concerning the Rental Disputes Settlement Centre in Dubai;

- Decree No. 4 Regulating the Transfer of Title to Granted Industrial and Commercial Land in Dubai.

The Dubai property law targets foreign citizens who want to move here but also enhances the regulations of those (UAE citizens, residents, and non-residents) already established here. Apart from this, such an important industry requires clear regulations that also favor investors.

The list of laws regulating real estate purchases is far more extensive which is why specialized advice and information can be provided by our property lawyers in Dubai.

Our law firm in Dubai can help you with real estate due diligence in Dubai and other legal services. Please contact our Dubai attorneys for more information. We are also at your disposal if you want to apply for a freelance visa in Dubai, one of the most recent types of residence permits available in this Emirate.